Senator David Woodsome, Chair

Representative Seth Berry, Chair

Joint Standing Committee on Energy, Utilities & Technology

My name is Dylan Voorhees and I am the Clean Energy Director for the Natural Resources Council of Maine (NRCM). Thank you for allowing us to present this joint testimony on these two closely related bills. NRCM strongly supports LD 1313—as printed—and opposes LD 1515. We do not support the amendment to LD 1313 circulated among parties yesterday, as explained below.

While several members of this committee are relatively familiar with the Regional Greenhouse Gas Initiative (RGGI), we know there are several members who may not be. Therefore we are providing background around this vitally important and enormously successful climate and energy initiative. Attached are several short documents that provide information about how RGGI works, and what its impact has been on emissions, our economy and energy costs. The news is overwhelmingly good, according to multiple independent analyses.

Background on RGGI Auctions & Use of Revenue

Under RGGI, fossil fuel power plants buy carbon credits (or “allowances”) sold at periodic auctions held by the nine participating states. A limit on emissions is created by limiting the number of allowances and decreasing that number over time. The cost of RGGI credits becomes a built in (or “internalized”, to use economic parlance) to the price of power that consumers pay. Because the consuming public pays the costs of RGGI, the states decided to use the revenue from auctions for public benefits. All ratepayers pay the cost of RGGI, therefore all should benefit directly.

Maine, like most RGGI states, has recognized that funding energy efficiency improvements returns the greatest public benefit with regard to energy costs, and until very recently, used approximately 85% of the funds for that purpose. That was wise policy, and one of the fundamental reasons why it is empirically true that Maine people pay lower total energy costs as a result of RGGI.

Until very recently, a small percentage of RGGI funds have been allocated to direct payments to ratepayers, first to all ratepayers and more recently to a small subset of large manufacturers who arguably are more energy-cost sensitive. This reflects the consideration that while energy efficiency returns much greater overall benefits, rate reductions can have an immediate benefit. NRCM has supported the inclusion of both, with the emphasis on maximizing overall cost reductions through energy efficiency.

At Efficiency Maine, RGGI funds are used for residential and business programs that save heating oil and unregulated fuels for which there is no other source of efficiency funding. Attached to this testimony are three case studies which illustrate how these RGGI-funded programs are helping homes and businesses lower energy costs.

The Present Challenge

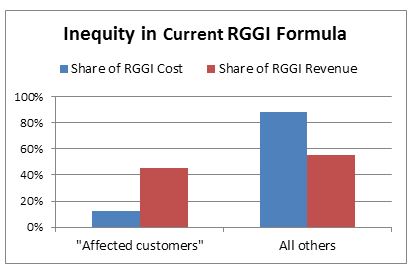

The decision in 2016 to allocate a fixed dollar amount to rate reductions for manufacturers (“affected customers”) was premised on increasing revenues from RGGI auctions. The $3 million allocation was estimated to be approximately 15-20% of the revenue from 2017-2019, which was both consistent with historic policy and roughly fair, considering that these customers pay approximately 10-15% of the cost of RGGI.

However, reality doesn’t always follow projections, and for reasons that may be distracting to consider here, the current revenue from RGGI is way below those forecasts. The current allocation is therefore not only inequitable, but has left a much lower amount for funding valuable energy efficiency programs.

LD 1313 & LD 1515

These two bills take very different directions with regard to use of RGGI revenue. As written, LD 1313 applies very simple approach: continue direct payments to affected customers, but determine the amount based on their share of RGGI costs. Nothing could be more equitable, and it works regardless of where RGGI revenues go. This would also provide sufficient funding for energy efficiency to continue the substantial energy savings for homes and businesses.

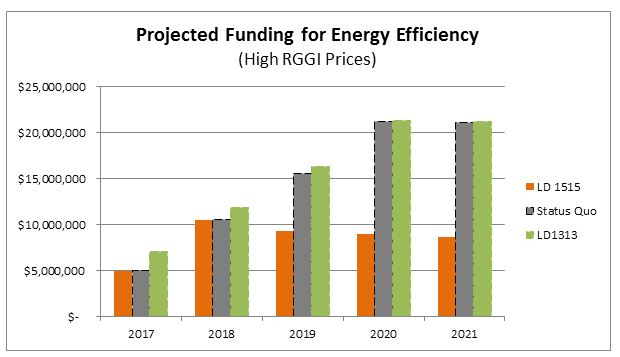

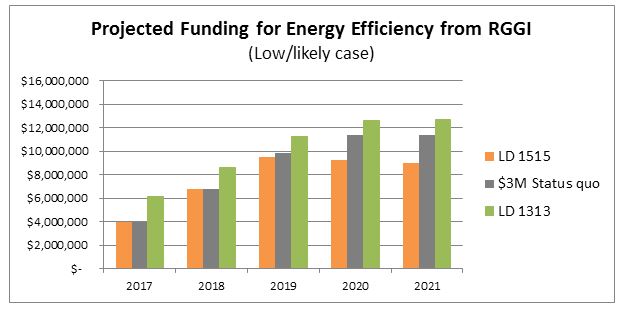

LD 1515 applies a much more complex formula that puts an increasing emphasis on direct payments instead of energy efficiency. The following chart shows projected funding for energy efficiency. The first shows the actual dollar amounts over the next several years, using a RGGI revenue forecast for growing but relatively low amounts. (A less likely high case scenario is shown on the final page of the testimony.)

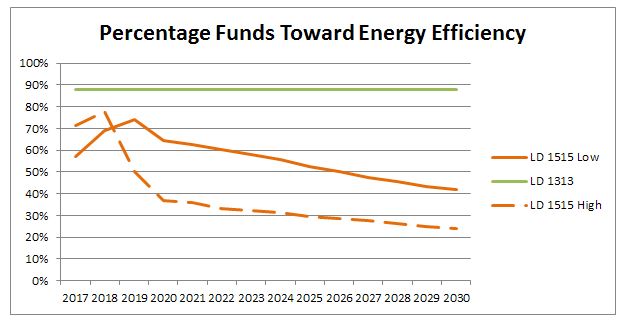

The second chart shows the percentage allocation for energy efficiency under the two bills over a longer time horizon (for both a low and high case.)

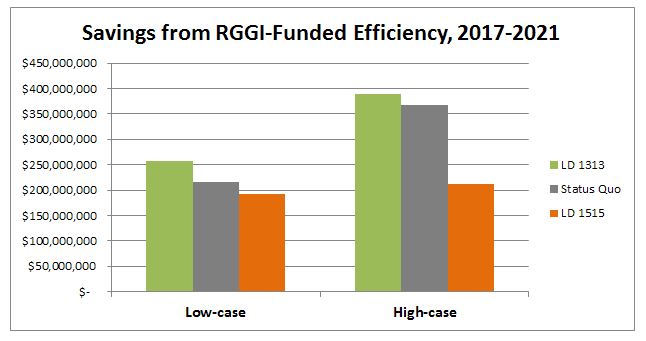

Of course the number Maine people and policymakers should focus more on is the result of these funding decisions. Based on Efficiency Maine’s historic performance with RGGI funds, the total savings from allocating efficiency funds are enormous. The third chart, on the following page, shows the total lifetime energy cost reductions from energy efficiency over the next five years under the status quo, LD 1313, and LD 1515.

By protecting and stabilizing energy efficiency initiatives, LD 1313 would save Maine homes and businesses $20-$40 million on energy bills, compared to the status quo over the next five years. In contrast, LD 1515 would cost Maine homes and businesses an extra $25-$155 million on their energy bills compared to the status quo. (The cost from lost energy efficiency savings grows substantially over time under LD 1515, making this approach especially problematic for energy consumers over the long-term.)

LD 1313 as Amended

NRCM greatly appreciates the efforts by Rep. Sanborn to bring forward this bill. It provides a constructive context for discussion of how policymakers need to respond to unforeseen circumstances and adapt in order to preserve equity and ensure continued progress on energy efficiency.

We do not support the amended language because it does not sufficiently achieve these objectives. The amended bill would result in affected customers, who contribute 12% of the cost of RGGI, receiving 30-35% of the revenue. It would require Efficiency Maine to significantly cut back if not eliminate the use of RGGI funding for business efficiency in order to maintain funding for residential efficiency. (The residential program funded primarily by RGGI has already been curtailed and Efficiency Maine has sought permission from the Public Utilities Commission to borrow from next year’s budget to maintain the program through this current fiscal year.) Small and medium-sized businesses—and even many large businesses—are the biggest losers in this scenario.

The amendment also includes language from LD 822. NRCM does not currently support that language, but it is much closer to policy we can support than LD 822 as printed. NRCM is open to joining these bills but it may not be necessary.

We look forward to continuing discussion about this issue, but in short we urge you to adopt LD 1313 as printed and reject LD 1515.

Thank you.